AlTareq: Enabling Open Finance in the UAE

Introduction: The Foundation of Open Finance in the UAE

Open Finance in the UAE is built on trust, security, and clear governance. At the heart of this ecosystem is AlTareq, the UAE’s national Open Finance platform, designed to enable safe and standardised connectivity between banks, licensed Third Party Providers (TPPs), and customers.

AlTareq establishes the regulatory, technical, and operational framework that allows Open Finance services , including data sharing and payment initiation services, to operate securely and consistently across the UAE. Spare helps bring these standards into real-world payment flows in alignment with the regulatory framework, through the AlTareq ecosystem.

What is AlTareq

AlTareq is the UAE’s Open Finance scheme governing how Open Finance works in the UAE. All parties involved in AlTareq are regulated and licensed by the Central Bank of UAE (CBUAE).

Its purpose is to:

Enable secure and standardised Open Finance services.

Ensure customer consent and control are central to all interactions.

Offer customers with more choice, convenience and personalized experiences.

Support innovation while maintaining regulatory oversight and consumer protection.

Through AlTareq, banks and TPPs can safely offer Open Finance use cases such as bank data sharing and payment initiation. Both AlTareq and licensed TPPs, including Spare, are regulated by the Central Bank of the UAE.

What is Open Finance

Open Finance is an initiative where customers can safely share their financial data with apps and services they trust. With their consent, it allows regulated providers to securely access and share information, such as bank accounts, insurance, or mortgages, through Spare to access more personalized, innovative, and convenient financial services.

AlTareq governs how this happens by defining technical standards, consent and authentication requirements, and security expectations, ensuring Open Finance services are delivered in a controlled and customer-centric manner.

Security, Consent, and Governance

Security and customer protection are core principles of AlTareq. The framework ensures that:

Customers explicitly approve every data share or payment.

Authentication remains under the control of the customer’s bank.

Through AlTareq, Spare operates within defined scopes and permissions as a regulated entity.

As a CBUAE regulated company, Spare operates within AlTareq’s defined scope to securely access financial data and initiate services with customer consent.

What this means for merchants ands customers

For merchants, AlTareq reduces fragmentation by providing a consistent national framework and scheme. For customers, it supports a more uniform Open Finance experience across participating banks.

AlTareq’s governance model ensures clear accountability and oversight on Open Finance. Customers remain in control of approvals, while merchants can rely on a framework designed to meet regulatory and security expectations. By enabling AlTareq within its flows, Spare supports Open Finance services that are governed, auditable, and aligned with national standards.

Open Finance Use Cases Enabled by AlTareq

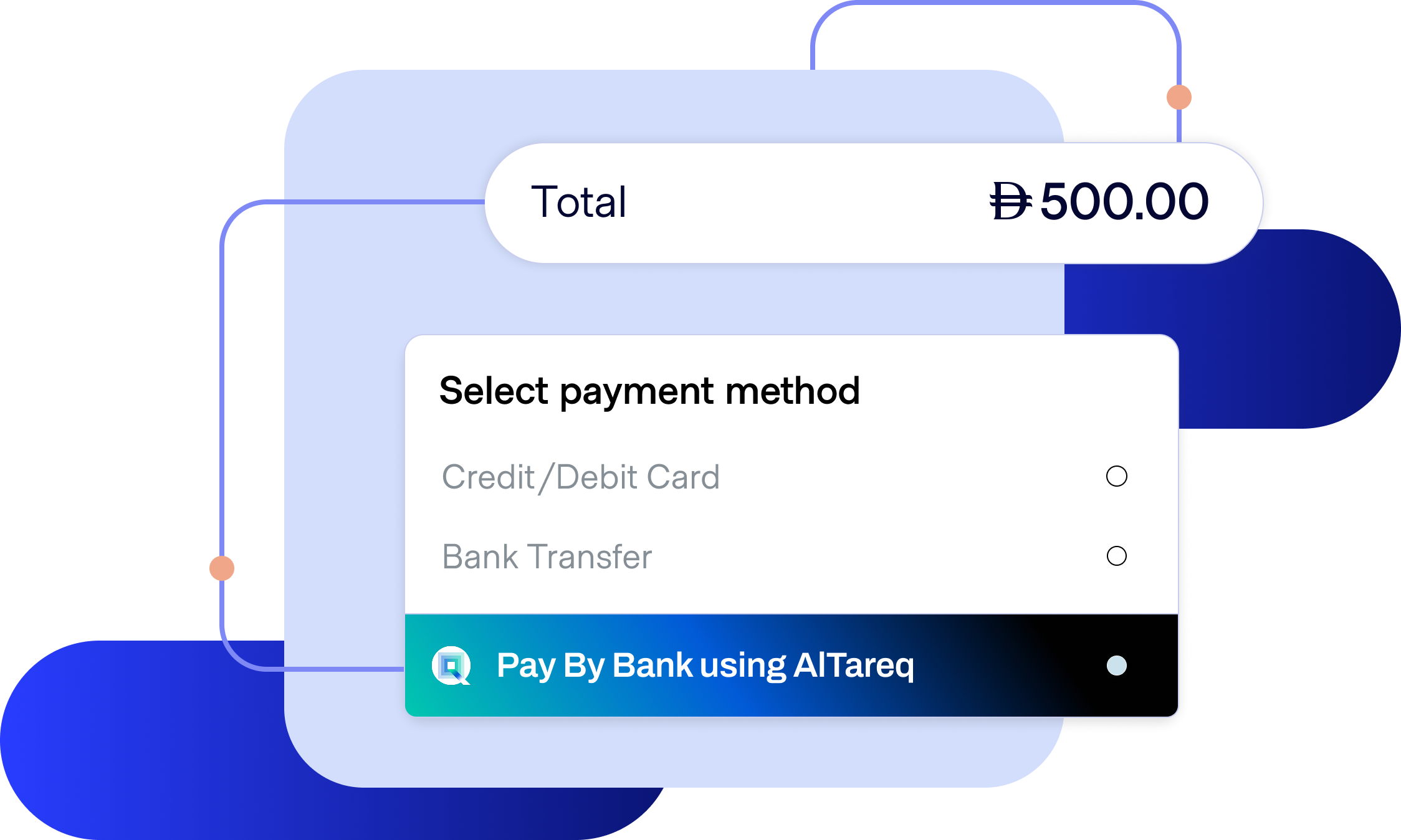

A. Pay By Bank

One of the key Open Finance use cases enabled through AlTareq is payment initiation, sometimes referred to as Pay by Bank.

Under this model:

Payments are initiated following customer approval through their bank.

Authentication takes place within the bank’s environment.

Consent is captured for every transaction.

While customer experiences may vary by bank, AlTareq ensures consistent standards for consent, authentication, and security across all participants.

What this means in practice

Customers benefit from account-to-account payments without entering card details, while merchants gain access to a regulated Open Finance payment flow supported by participating banks. Spare supports this by connecting merchants to the AlTareq framework and approved payment initiation journeys.

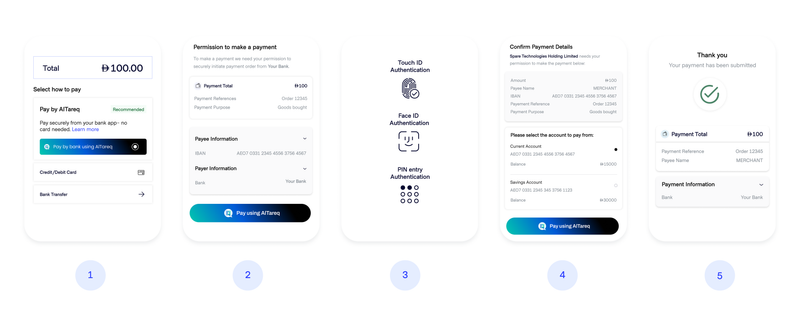

How Pay By Bank works with Spare

User Selects Pay by bank using Altareq

User Grants Payment Consent

Bank Authenticates Identity

Bank Account Selected

Payment Authorized & Executed.

B. Bank Sharing Services

Customers can allow licensed providers to access selected account information through their bank, with explicit consent.

What this means in practice?

Customers have greater visibility and control over financial information, while businesses have the ability to build data-driven services within a regulated framework.

How Spare aligns with AlTareq

Licensed Third Party Providers, such as Spare, deliver Open Finance services within the boundaries defined by AlTareq, while banks retain control over authentication and account security.

Spare operates within this role to support Open Finance payment and data sharing use cases while respecting the responsibilities and controls established by the framework.

Get in touch today to learn how you can enable Open Finance use cases for your business.